Venture Capital under-invests in socially valuable university research commercialisation

Steve Baxter claimed the Australian Government’s recent $2 billion university research commercialisation package was giving more “lolly” to university “passion projects”. Our Managing Partner, Geoff Waring explains why this view is misplaced.

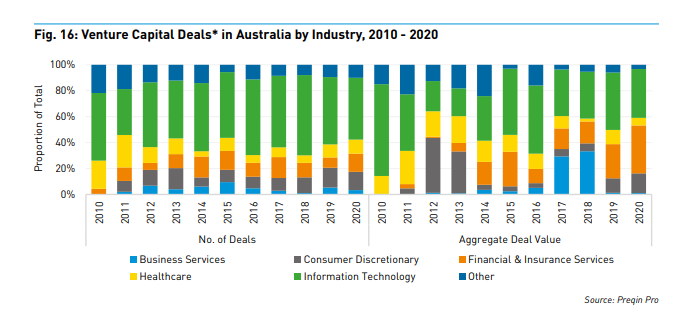

A tiny share of venture capital goes to the most socially valuable, science-based, university research commercialisation. According to the Australian Investment Council’s 2021 Yearbook, 75% goes to the IT (38%) and fintech (37%) sectors which are nearly all software companies. Only 6% went to healthcare, much of which comes from university medical research.

The Australian Government’s policies attempt to offset the fact traditional venture capital directs inadequate finance to the innovations that address our big social problems like climate change and pandemics.

While software companies (especially IT and fintech) receive the majority of total venture capital invested, many of these companies do not improve our quality of life much. For example, buy now pay later fintech companies encourage over-consumption.

Why venture capital prefers investing in software to more socially beneficial university science-based innovations

Firstly, venture capital investors can invest in software innovations with little risk by dribbling small amounts of capital to founders until customers start buying, when they can then invest hard as the risk customers will not pay has been resolved. This is highlighted by the steeper software curve in the below graph.

However, university research innovations that work at small scale in the lab often will not work at large scale on an industrial site. The risk stays high until large scale production.

So the risk of technological failure persists for many years in science-based innovations.

This scares off most venture capital investors. Those that stay manage the risk by continuing smaller but frequent rounds of milestone-based financing, as shown in the above graph by the flatter Deep Tech line.

Secondly, research shows investors follow herd behaviour. Venture capital firms over-invest in incremental, trendy innovations that other venture firms hype, rather than unique and radical innovations. Think of cryptocurrency and the metaverse rather than an antibiotic that bacteria cannot build resistance to.

Thirdly, university innovations are developed by researchers who cannot easily leave their academic job to lead the company for several years without damaging their academic publication record and hence their university career.

But venture capital firms give a large weight in their decision to invest to the quality of the founding team. If the researcher is not likely to join the team, the investor is less likely to invest.

Society cannot hope the traditional private venture capital sector will adequately invest in socially valuable innovations. The government, universities and venture capital firms must innovate to fill the gap.

![]()

Venture Capital under-invests in socially valuable university research commercialisation was originally published in Stoic VC on Medium, where people are continuing the conversation by highlighting and responding to this story.